32+ fha reverse mortgage guidelines

Web Changes in Reverse Mortgage 2019 Guidelines. Ad Compare the Best Reverse Mortgage Lenders.

What Are The Fha Minimum Property Standards In Order To Obtain A Reverse Mortgage

Ad Refinance Your House Today.

. However lenders prefer that. Refinance Your FHA Loan Today With Quicken Loans. Web The FHA appraisal cost is one of several reverse mortgage closing costs.

A maximum of 35 of the total floor area of the property may be used for non-resident or commercial. Web Reverse Mortgage Rules Requirements. While the Manual.

Web 2022-23 COVID-19 Home Equity Conversion Mortgage HECM Property Charge Repayment Plan. Must own home outright or have small mortgage. For Homeowners Age 61.

I would like to know the exact reverse. Get A Free Information Kit. Ad Looking For Reverse Mortgage For Seniors.

Comparisons Trusted by 45000000. Ad Compare the Best Reverse Mortgage Lenders. Web Mae servicing-related guidelines for reverse mortgage loans.

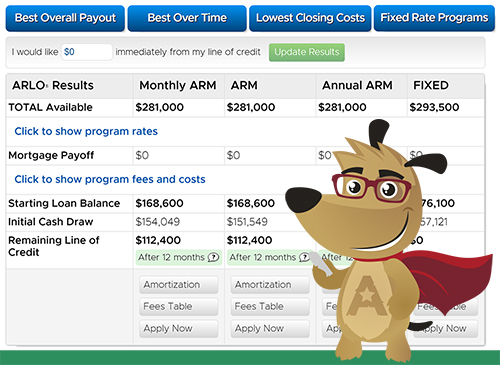

Get A Free Information Kit. An Overview Of Reverse Mortgage And How It Works. Web Reverse Mortgage Property Requirements Updated 2023 September 17 2022 By Michael Branson 88 comments.

2022-22 Clarification of Conflict of Interest and Dual Employment Policy. Conventional Home KeeperTM mortgage loans and FHA HECM loans. Discover The Answers You Need Here.

For Homeowners Age 61. The reverse mortgage loan has continued to evolve since its introduction in 1961 and only grows stronger and safer with each year. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. The FHA recently issued new reverse mortgage rules requiring lenders to submit their reverse mortgage. Web Reverse mortgages are a way for older homeowners to borrow money based on the equity in your home.

For Homeowners Age 61. Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage. For Homeowners Age 61.

Well Talk You Through Your Options. Calculate Your Monthly Payment Now. You must have significant equity in your home usually more than 50 to get a reverse mortgage.

Ad 2023s Trusted Reverse Mortgage Reviews. Web Ownership status requirements. Web At least 50 of the units must be owner-occupied.

Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Additional fees borrowers may pay include.

Fha Reverse Mortgage Appraisal Requirements Goodlife

Reverse Mortgage Net

Fha Reverse Mortgage Its Pros Cons

2017 Reverse Mortgage Limit Increased To 636 150 Mls Reverse Mortgage Powered By Zyng Mortgage

:max_bytes(150000):strip_icc()/GettyImages-13550670851-701f649a0c7d4c7faed160daacd5962b.jpg)

Fha Reverse Mortgage Loans

Fha Reverse Mortgage Loan Program Landmark Mortgage Capital

:max_bytes(150000):strip_icc()/senior-african-american-couple-sitting-on-porch-outside-house-623699434-588b91685f9b5874ee5726fa.jpg)

Fha Reverse Mortgage Loans

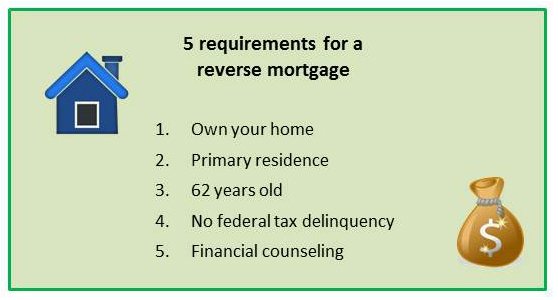

What Is A Reverse Mortgage Reverse Mortgage Requirements

Reverse Mortgage Property Requirements Updated 2023

Fha Reverse Mortgage

Reverse Mortgages On Rural Properties What You Need To Know

Fha Reverse Mortgage Loans American Advisors Group

Reverse Mortgages On Rural Properties What You Need To Know

5 Rules That Apply To Reverse Mortgages In 2023

Paul Skeens Bio

Fha Reverse Mortgage Its Pros Cons

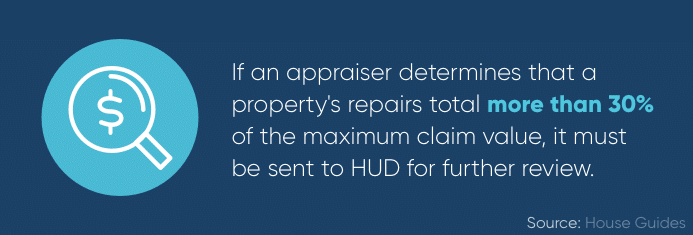

Fha Reverse Mortgage Appraisal Guidelines